Social security claiming strategies for married couples calculator

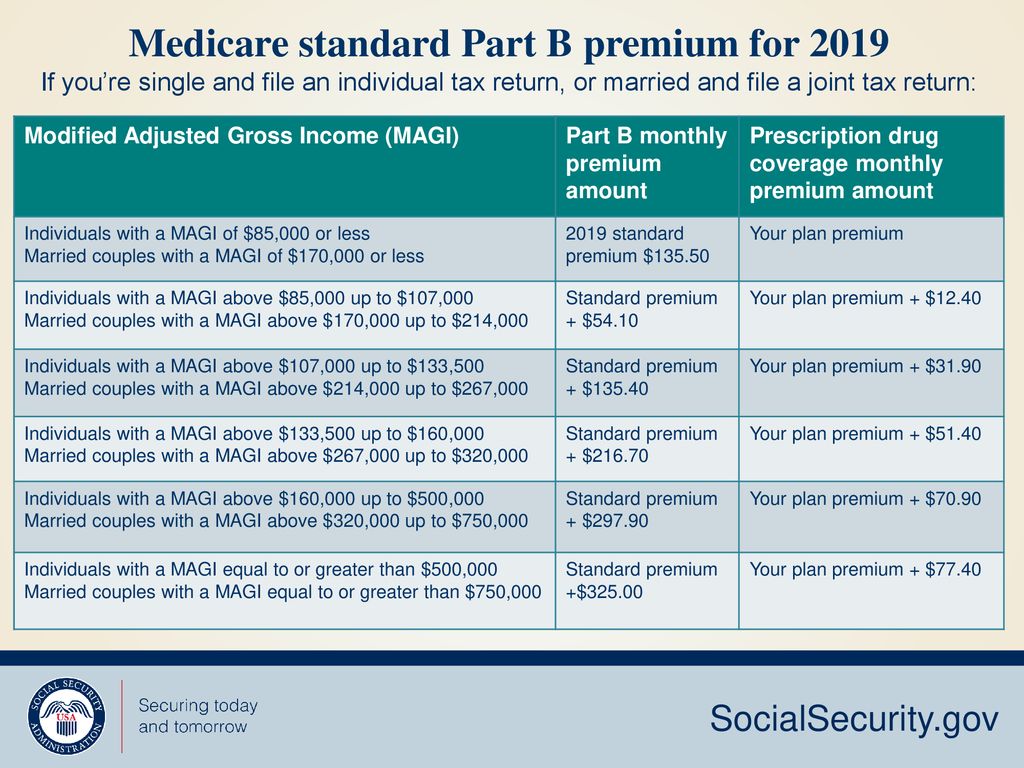

Retirement income needs to be viewed on an after-tax. The calculator evaluates scenarios and benefit options available between ages 62 and 70 for each spouse.

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

Financial Engines Social Security Retirement Calculator estimates Social Security benefits and produces claiming strategies for 1 a single person eligible for earned benefits.

. Get nothing for four years and then 6864 thereafter. View Alternate Social Security Strategies. Another factor overlooked by singles and married couples alike is the impact of taxes.

If you are married you need to use a retirement calculator for married couples or a retirement calculator for couples. You can play What-if simulations with future income and select. Once her husband claims his Social Security the excess spousal amount of 400 would be added to her permanently reduced benefit of 750 for a total new benefit of 1150.

Enter estimated monthly Social Security retirement benefit and the benefit age 62 to 70 for which the estimated monthly benefit applies. This calculator costs 40 for a yearly household license. In addition to an.

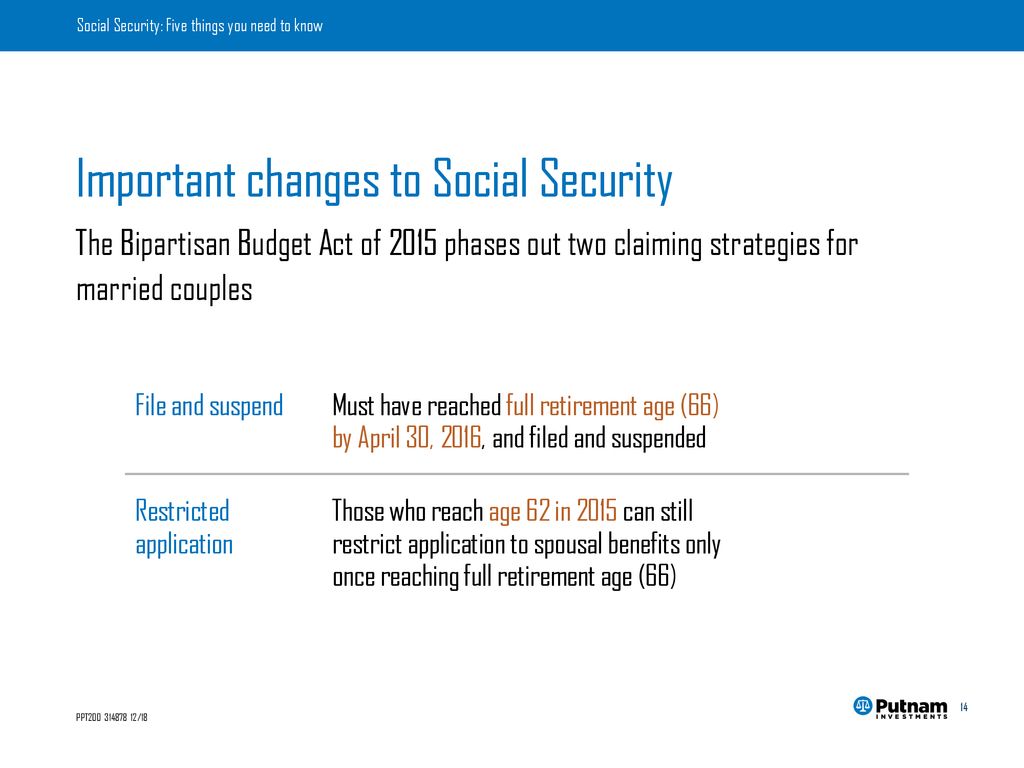

If youre married this decision can be especially complicated because you and your spouse will need to plan together taking into account the Social Security benefits you may. If you or your spouse reached age 62 by the end of 2015 you qualify for a Social Security claiming strategy called restricted application. For married couples Social Security is just one part of retirement planning but its one that tends to raise no shortage of questions.

A The 6670 strategy. If an individual is older than 62 the calculator will evaluate options available for. Deciding when to start claiming your benefits.

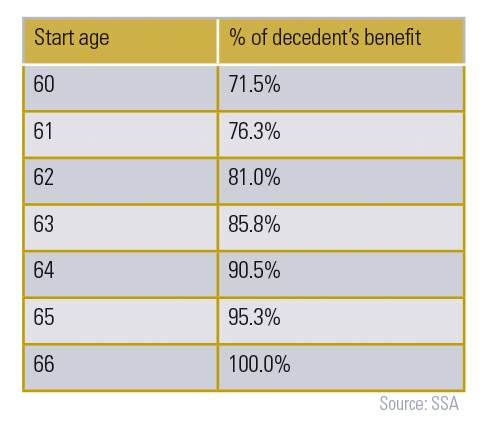

With any couple theres a 50 chance one member be alive at 92 according to the Society of. Taxes on Social Security. The tool provides a benefit estimate for three claiming ages.

Age 62 your full retirement age and age 70. The younger spouse who. Have the higher earner claim Social Security early.

For example if a couple is married for 10 years or more and then decides to part ways each spouse is entitled to a certain percentage of the Social. As part of the Bipartisan Budget Act of 2015 Congress. It asks that you input both your.

File and suspend also known as claim and suspend was a maneuver for married couples to maximize benefits. Claiming strategies for married couples or divorced people who were married to their ex-spouse for at least 10 years can differ drastically from those employed by singles. B The 7070 strategy.

Heres how it works. You can obtain the benefit amount from a Social. But 1 out of 3 65-year-olds will live past 90 and about 1 in 7 will live past 95.

Get 3900 a month for four years and then 6032 thereafter. If youre retiring early but will need a hefty Social Security payday to keep up with your. In most cases for the spouse in a married couple who has the higher of the two primary insurance amounts delaying Social Security is just like that but better.

Make sure you have your personal information ready to go when you first use this one. If Mary and Sam.

Optimal Claiming Of Social Security Benefits The Journal Of Retirement

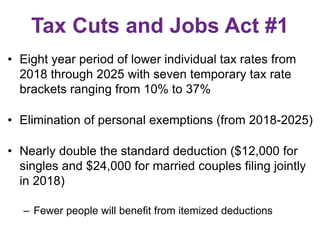

Njcfe Webinar Tcja Income Tax Update

How The Tcja Tax Law Affects Your Personal Finances

2

Retirement Calculator For Couples Married Or Not Retirement Calculator Retirement Retirement Planner

Social Security Five Things You Need To Know Ppt Download

Financial Planning For Newly Married Couple Simple Tax India

How The Tcja Tax Law Affects Your Personal Finances

Here S When Married Filing Separately Makes Sense Tax Experts Say

Social Security Benefits Strategies For Divorcing Spouses

Social Security With You Through Life S Journey Ppt Download

Optimal Claiming Of Social Security Benefits The Journal Of Retirement

Here S When Married Filing Separately Makes Sense Tax Experts Say

Is There A Cap On Two Earner Social Security Retirement Benefits

What To Know About The Marriage Tax Penalty

The 66 70 Social Security Strategy For Married Couples

How The Tcja Tax Law Affects Your Personal Finances